加裕养猪评论——在西班牙的加裕核心场

发布: 2017-04-02 | 作者: 佚名 | 来源: 转载

加裕养猪评论

Pork Commentary

加裕总裁兼CEO Jim Long

Jim Long, President-CEO Genesus Inc.

2017年3月20日

March 20, 2017

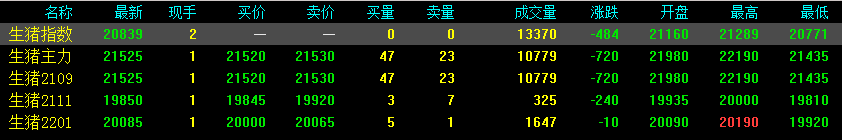

美国瘦肉型生猪价格在过去几周保持平稳,53-54%瘦肉率生猪价格停留在0.71美元/磅。

The U.S. lean hog price is flat lining over the last couple weeks, hovering around $0.71/lb for 53-54% lean hogs.

其他观察

Other Observations

“一周前爱荷华-明尼苏达生猪平均活重281.9磅,相比去年(283.4磅)下跌了1.5磅。告诉我们生猪正在朝和一年前一样的趋势变化。

”早起断奶猪和架子猪暂时保持着相对强劲的价格,反映出市场良好需求以及稳定的供应情况。上周,早期断奶猪现货的平均价格是每头42.36美元,架子猪现货价格是每头76.73美元。架子猪的价格映射出7月下旬市场周期。早期断奶猪则反映9月中旬到下旬的市场周期。

“上周,美国53-54%的瘦肉型猪价格是0.71美元/磅。一年前还是0.65美元/磅。0.06美元的差异相当于每头猪比去年高出13美元。

”上周,美国销售出栏了233.5万头生猪。去年的同一星期是218.8万头,增加了6.5%。年初至今,美国销售出栏2527.2万头生猪,比去年的2445万头增加了0.7%。年初至今,小幅上涨,但瘦肉型猪价格走强表明需求旺盛。

“Iowa-Minnesota Average Hog Weight a week ago 281.9 lbs liveweight, down 1.5 lbs from a year ago (283.4 lbs)。 Tells us hogs are moving about the same schedule as a year ago.

”Early weans and feeder pigs are staying at relatively strong prices reflecting good demand and moderate supply. Last week, cash early weans averaged $42.36 USD each and cash 40 lb feeder pigs $76.73 USD each. Feeder pig prices reflect a late July marketing period. Early weans mid to late September.

“Last week, U.S. National Base Lean hogs 53-54% were $0.71 lb. A year ago, they were $0.65/lb. The $0.06 difference is $13/head higher than last year.

”Last week, U.S. hog marketings were 2.335 million. A year ago, the same week was 2.188 million, a 6.5% increase. Year to date, U.S. hog marketings are 25.272 million, up 0.7% from last year's 24.450 million. Year to date, a small increase but stronger lean hog prices are indicating good demand.

“当考虑到总供给,加拿大和美国市场是息息相关的。年初至今,加拿大屠宰了411万头生猪,比去年增加了20,000头。出口到美国的生猪总量是99.3万头,比去年同期(包括出栏生猪,小猪,母猪,公猪)减少了10,000头。很明显,加拿大的总产量基本与去年相同,没有像美国的总产量与去年行情相比大幅改变。

”Robert Hunsberger每周计算加拿大的盈利能力,他估计,按照目前的价格,从分娩到育肥阶段生产者的每头猪的平均利润是18.5美元。他还根据瘦肉型猪、玉米和豆粕的长期合约价格,研究了未来一年的盈利能力。目前研究表明未来12个月每头猪盈利17.25美元。

“在美国屠宰加工厂和屠宰毛利润已经从高点下跌了几个月。现在每头猪20-25美元浮动,然而几周之前还不止50美元。随着美国新工厂的投产,未来几个月屠宰利润变化将会变得有趣起来。当加工厂屠宰加工能力大大超过供应的时候,我们不希望看到好几年每头猪能有50美元的屠宰利润。在我们看来,10月份瘦肉未来价格将在每磅0.67美元,12月价格每磅0.63美元,反映了真实的大型屠宰加工产能,相对于去年秋天,当时瘦肉猪价是40美分,而且低屠宰量给供应商们没有多少市场灵活性。

”Canada and U.S. are closely linked when you consider total supply. Year to date Canada has slaughtered 4.110 million hogs, up 20,000 head from a year ago. Total Live Hog Exports to U.S.A. are 0.993 million head, down 10,000 from the same time a year ago (combined market hogs, small pigs, sows, boars)。 Obviously, Canada's total production is almost the same year over year, not altering the U.S. total year over year picture significantly.

“Robert Hunsberger does a weekly calculation of profitability in Canada. He estimates at current prices, average producers' profit from farrow to finish is $18.50 USD per head. He also projects profitability for a year ahead using forward contract prices of Lean Hogs, Corn, and Soymeal. Projection currently is $17.25 USD per head profit for next twelve months.

”The U.S. Packer Kill and Cut Gross Margin has come down from the lofty heights it had for a few months. It is now in the $20-25 range/head, while for several weeks it was over $50. It will be interesting where the Packer margin goes over the coming months, as the new U.S. plants come on line. We don't expect to see $50 per head packer margins for years as packer capacity coming into production far exceeds what will be supply. In our opinion, October Lean Futures at $0.67/lb and December at $0.63/lb reflect the reality of greater packer capacity relative to last fall when lean hogs were in the 40's and low packer capacity gave suppliers little market flexibility.

“这周,因为我们透露了Topigs-Norsvin在上一个财政年度损失了691万美元的事实,有人问道我们与对方是否有过节。事实上,我们觉得有意思的是,他们声称自己是第二大基因公司(实际上,没有人知道),但是当他们损失了691万美元的时候,PIC(世界最大的基因公司)同年盈利了5000万美元。没有不和,只有疑惑。

”上周,我们把时间花在了现有33,000头母猪生产的两家俄罗斯公司。两家都有屠宰加工厂。两家都有超过100,000英亩的广阔土地。两个公司都在扩张到12,000头以上母猪规模。俄罗斯市场保持着较好的盈利情况,尤其是当他们生产经营良好时候。每头猪盈利可超过50美元。俄罗斯如果能使生产更有竞争力,就可以有和世界上任何地方一样低的生产成本(饲养员)。一些更好的企业正是如此,不过仍然有上升的空间。在俄罗斯比较好的生猪价格是99卢布/每公斤(0.76美元活重/每磅),比巴西0.53美元/磅和美国0.51美元/磅要高出50%,西班牙的价格是0.6美元/磅。俄罗斯生产商受益于限制进口猪肉的制裁,这增加了价格和利润。现实情况是生猪价格上涨,使得更加难以有竞争力地出口猪肉。作为一个生产商,如果有机会选择,我们将会在出口上获得更多的利润。

“This week, we were asked if we were having a feud with Topigs-Norsvin because we revealed the fact they had financial losses of $6.91 million USD in their latest fiscal year. Indeed, what we find interesting is that they claim to be the second largest genetic company (actually, nobody really knows), but then they lose $6.91 million USD while PIC (the largest genetic company) makes around $50 million USD a year. Feud not, bewilderment yes.

”This past week, we spent time with two Russian companies with combined existing production of 33,000 sows. Both have packing plants. Both farm large tracts of land, over 100,000 acres. Both companies expanding up to 12,000 more sows. Profits continue to be good in Russia, especially if they can get good production. Profits over $50 USD per head. Russia can have as low a cost of production (feed-labour) in the world as anywhere if they can get competitive production. Some of the better companies are, but there is still room for improvement. The better hog price in Russia, 99 rub/kiloweight ($0.76 USD liveweight/lb), is 50% higher than Brazil at $0.53 USD/lb and U.S. at $0.51 USD/lb, while Spain is at $0.60 USD/lb. Russian producers benefit from sanctions that restrict pork imports, this increases prices and profits. The Reality is the higher hog prices also will make it more difficult to export pork competitively. As a producer, we would take higher profits over exports if we had the choice.

在西班牙的加裕核心场

加裕公司- Catalana de Pinsos

Genesus Nucleus in Spain

Genesus - Catalana de Pinsos

加裕公司十分高兴地宣布在西班牙的Catalana de Pinsos作为我们的合作伙伴之一,用于生产种猪,现在可以购买来自“La Tor Nucleus Unit”核心场的后备母猪。有了Catalana de Pinsos,我们正在生产加裕高健康纯种母猪,不久之后,来自“Raurell Multiplier Unit”父母代猪场的加裕F1代后备销往西班牙和欧洲。

由Ballus家族在1968年建立的Catalana de Pinsos,已经将农场致力于纯种后备和F1代后备生产。他们的农场位于西班牙Catalonia封闭的Pyrenees 山脉地区。

Manel Ballus总裁,同Fermin Xixos总经理一起,成功地监管13000头母猪生产。Catalana de Pinsos支持创新、科学,和高效地养猪生产,并且他们已经同加裕公司从这个项目中发现了这点。

加裕公司十分自豪的宣布我们拥有来自Catalana de Pinsos的后备母猪可供购买。

Genesus is pleased to announce that gilts are now available for purchase as a part of our partnership with Catalana de Pinsos for the production of breeding stock in Spain from “La Tor Nucleus Unit”. With Catalana de Pinsos, we have been producing our Genesus high health pure maternal lines, and soon, our Genesus F1 gilts from “Raurell Multiplier Unit” for Spain and Europe.

Established in 1968 by the Ballus family, Catalana de Pinsos has farms dedicated to both purebred gilts and F1 gilts production. Their farms are located in isolation in the Pyrenees Mountains region of Catalonia, Spain.

CEO Manel Ballus, along with his General Manager Fermin Xixos, successfully oversee 13,000 sows of production. Catalana de Pinsos favour innovation, science, and efficiency in swine production and they have found it with Genesus for this project.

Genesus is happy to announce that we have gilts available for purchase from Catalana de Pinsos.

For more information, please contact Mercedes Vega:

Telephone: +34-630-61-7001

Email: mvega@genesus.com