加裕养猪评论:中国养猪户比美国养猪户赚钱

发布: 2017-05-05 | 作者: 佚名 | 来源: 转载

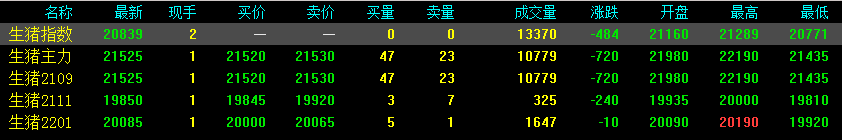

中国目前的生猪活重价格是16.49人民币/kg,即活重1.08美元/磅。美国活重价格是0.47美元/磅,西班牙是0.62美元/磅。不难算出,中国养猪户比美国养猪户每养一头猪多收入125美元。这反映了中国国内的供需关系。

China’s current hog price liveweight is 16.49 CNY/kg, or $1.08 USD liveweight/lb. The U.S.A. liveweight price is $0.47/lb and Spain $0.62/lb. It doesn’t take an ag-economist sitting in a university cubicle to figure that Chinese producers are receiving up to $125 per head more than U.S. producers. A reflection of Chinese domestic supply and demand.

其他观察

Other Observations

• 尽管中国农业创历史记录,但是2月份的报告显示,中国母猪规模相比1月份进一步减少了0.5%,跌至3630万头。中国母猪群体规模已经比2013年2月的4500万头减少了900万头。显然,如果母猪群体规模继续减少,生猪数量很难提升起来。

• 中国月份进口了吨猪肉,同比增长。我们计算一下,这个吨位等于这个月内进口了约万头生猪。十分明显,中国的供应还远远不能满足目前的需求水平。如果中国生猪价格下跌,降低猪肉价格将会刺激猪肉消费,增加吨位需求。

• 在美国,近几年一直没有富余的屠宰能力。屠宰加工商有较好的的利润。因此,正在投建新的屠宰加工厂。在中国,就是一个完全不同的情况了。结果是减少了万母猪。根据中国农业部统计,中国有个生猪屠宰场。他们在新鲜猪肉分割(占)和加工猪肉产品(占)之前,仍然有的胴体产出。他们目前以的产能工作。啊!即使是生产万头猪的双汇(史密斯菲尔德)也在以的产能工作。初级加工的平均利润率是,而大规模的二次加工的利润则有。令人吃惊的是,在年到年期间,大型屠宰场的生猪屠宰比例已经下降了到。

• 中国养猪生产的一个制约因素是政府需要考虑政策措施,在土地法和补贴方面,既关注到环境保护,又要保证生猪供应。现在,由于环保政策,许多养猪户直接被迫关闭或拆除猪场。以上可知,上面这些因素是中国母猪规模持续下降的部分原因。

• Despite record profits, China Agri reports that in February, China’s sow herd declined further 0.5% from January to 36.3 million. China’s sow herd has declined about 9 million from 45 million in February 2013. Obviously, it’s hard to increase hog numbers if sow herd keeps declining.

• China imported 181,900 tonnes of pork in February, an increase of 153.8% year on year. We calculate this tonnage is equal to about 2 million market hogs imported for the month. It is obvious China’s supply is far from meeting its current demand level. If and when the hog price declines in China, lower pork prices will increase pork consumption, increasing tonnage demand.

• In U.S.A., there has been no surplus of slaughter capacity over the last while. Packers have had good margins. Consequently, new packing capacity is under construction. In China, a different story. The consequence of 9 million fewer sows. According to China Agri, there are 5,000 pig abattoirs in China. They still produce carcasses (65% of output), ahead of fresh pork cuts (20%) and processed pork products (15%). They are currently working at 30% capacity. 30%! Even Sheung Shui (Smithfield) with an output of 13 million pigs works at 40% capacity. Average margin for primary processing is 5.5% against 20-30% for large-scale secondary processing. Surprisingly, the percentage of pigs slaughtered in large abattoirs has fallen from 24% to 31% between 2010 and 2016.

• One of the constraints on China’s swine production is the government’s need to consider its policy package to address concerns of both environment protection and pork supply in terms of land law and subsidies. Currently, many hog farmers are simply forced to shut down or demolished due to the environmental policy. From what we can understand, these factors are part of the reason China sow inventory continues to decline.

当养猪行业利润高的时候,总是会有很多公司扩张。中国也不例外。不是如果,而是现在。每个月每头猪盈利100美元左右将导致更多的猪出现。

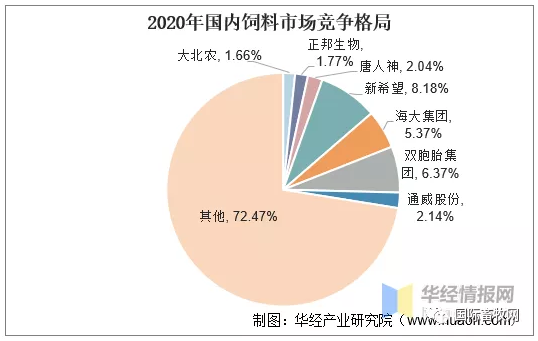

在加拿大种猪出口协会Hu Song的一份报告中,猪肉行业是2016年中国投资者的一个热门领域。在股票市场中与养猪相关的上市公司总投资有414亿人民币(60亿美元),占整个畜牧业总投资的84.8%,相比2015年增加了9.5倍。2016年共投资了22个省的153个养猪项目。据估计新建猪场设计产能是年产2700万头生猪(新希望分析师王晓岳女士)。

在2016年,加裕公司是出口种猪基因到中国的全球领先出口国。2017年,我们将会继续关注中国新建猪场的情况。有意思的是,到目前为止母猪群体清盘的速度一直超过新建猪场的速度。

十亿美元的问题:这个现象什么时候结束?

When there are good profits in the hog industry, there is always expansion. China will be no different. It’s not if, but when. Profits of around $100 USD per head month upon month will lead to more hogs.

In a report from Hu Song of CSEA, the swine sector is a hot area for Chinese Investors in 2016. The total investment related to swine from public companies in stock markets was 41.4 billion RMB ($6 billion USD), accounting for 84.4% of total investment in the livestock sector, increased by 9.5 times compared to 2015. The 2016 investments were spent in 153 swine projects, located in 22 provinces. It is estimated the new barns will produce 27 million hogs per year on its designed capacity (Ms. Wang Xiaoyue, analyst from New Hope).

In 2016, Genesus was the global leading exporter of swine genetics to China. We continue to see the reality of new sow barns in China in 2017. The interesting factor is up to now liquidation of existing sow herds continues to outstrip the new construction.

Billion dollar question: when will that phenomenon stop?

Lorne Tannas担任中国区总经理

Lorne Tannas Appointed General Manager, China

Lorne Tannas

T (Canada): 1-204-730-2007

T (China): 86-136-1117-1945

E: lvt@mymts.net

加裕公司高兴地宣布,Lorne Tannas担任中国区总经理。Lorne在养猪生产中有着卓越的履历。

Genesus is pleased to announce Lorne Tannas as General Manager, China. Lorne has had a distinguished career in swine production.

工作经历:

Experience:

• 从事养猪行业超过30年,曾在几个大型公司担任生产经理和主管

• 主管/经营加裕2500头母猪规模核心猪场-15年加裕客户

• 10年加拿大农业养猪研究

• 10年阿西社区学院经历,教学养猪管理项目和熟练工人管理程序

• 撰写过许多应用于养猪行业的课程、技术文件和标准操作程序

• 多年以来在加拿大,美国,墨西哥,菲律宾,中国做过多次演讲汇报

• 已经在中国技术支持加裕核心场4年

• Over 30 years in the Swine Industry, working as production manager and supervisor in several large systems

• Was owner/operator of 2500 sow Genesus Nucleus barn – 15 years Genesus customer

• 10 years Agriculture Canada Swine Research

• 10 years Assiniboine Community College, teaching Swine Management Program and Journeyman Swine Technician Program

• Author of numerous courses, technical papers and standard operating procedures used in the swine industry

• Has spoken and done many presentations over the years – Canada, United States, Mexico, Philippines, and China

• Has worked for 4 years in China as Nucleus and Production Support for Genesus

教育经历

Education:

• 工商管理学位证书

• 养猪技术证书

• Diploma in Business Administration

• Swine Technician Certificate